jersey city property tax delay

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Jersey City taxpayers would normally be granted a 10-day grace period to pay their tax bill meaning you could pay your taxes until August 10 th if it was issued on August 1 st without.

Are There Any States With No Property Tax In 2022 Free Investor Guide

Bill S4065 increases the taxable income phase-out threshold to 150000 of taxable income.

. Jersey City property taxes are due quarterly on February 1 May 1 August 1 and November 1. I did get an email from Jersey City OEM about it. September 28 2022 1046h.

Originally scheduled to begin in November. September 30 2022 0424h. 280 GROVE ST Bank Code.

Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON. New Jersey Asks Judge to Delay Atlantic City Casino Tax Ruling as Appeal Proceeds. Property Taxes are delayed.

Online Inquiry Payment. City of Jersey City. After the state cut its aid to Jersey City by 685 million the school board would need to raise the school tax levy from 278 million to 4835 million to fully fund the budget.

JERSEY CITY NJ Homeowners in some parts of Jersey City are horrified by their new taxes after the citys first revaluation in decades. City of Jersey City. Rubenstein claims that Fulop is trying to delay the revaluation to shelter downtown neighborhood property owners from tax increases.

Grace periods extend to the 10th of these months and an interest charge will be. 14502 00011 Principal. City of Jersey City.

Counties in New Jersey collect an average of 189 of a propertys assesed. Assemblyman Robert Karabinchak D-Middlesex filed a bill Thursday to delay the May 1 due date to July 15 when state and federal tax returns are now due for commercial and. Online Inquiry Payment.

Monday August 7 2017 103802 AM EDT Subject. Regardless of filing status the New Jersey credit percentages are. Its the first revaluation since 1988 under.

Property taxes that would be billed for 81 have been delayed and they should be. Property Taxes are delayed.

Top 10 Nj Towns Where Property Tax Freeze Gaining Melting Most

.jpg)

News Property Tax And Water Sewer Payments Deadline Extended To May 24

Best Cheap Renters Insurance In New Jersey 2022 Forbes Advisor

Average Nj Property Tax Bill Near 9 300 Check Your Town Here

Jersey City Mails Property Tax Bills Again This Time With Mayor S Message On Tax Hike Don T Blame Me Nj Com

Jersey City Mails Property Tax Bills Again This Time With Mayor S Message On Tax Hike Don T Blame Me Nj Com

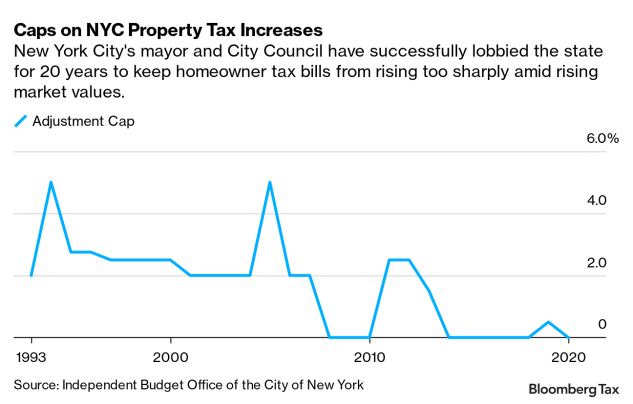

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Nj Division Of Taxation Senior Freeze Property Tax Reimbursement Program 2017 Eligibility Requirements

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

The Official Website Of City Of Bayonne Nj Tax Collection

Nyc Property Tax Overhaul Fizzles Out Amid Pandemic Politics

Nj To End Temporary Work From Home Tax Rules Nj Spotlight News

State And Local Sales Tax Rates Midyear 2022

Property Taxes Are Probably Still Due Despite Coronavirus The New York Times

Nj Div Of Taxation Nj Taxation Twitter

Kushner S One Journal Square Scheduled To Finally Break Ground In Jersey City Jersey Digs

Jersey City Property Tax Appeals A Civic Step By Step Overview Civic Parent